Heat Treat Tomorrow – Hydrogen Combustion: Our Future or Hot Air?

![]() Doug Glenn, publisher of Heat Treat Today, moderates a panel of 5 experts who address questions about the growing popularity of hydrogen combustion and what heat treaters need to do to prepare. Below is an excerpt of this lively and compelling discussion.

Doug Glenn, publisher of Heat Treat Today, moderates a panel of 5 experts who address questions about the growing popularity of hydrogen combustion and what heat treaters need to do to prepare. Below is an excerpt of this lively and compelling discussion.

To view the 1-minute trailer or register to watch this FREE video, go to www.heattreattoday.com/2021-09-H2-Vid.

Today’s Technical Tuesday was originally published in Heat Treat Today's December 2021 Medical & Energy print edition.

Introduction

Doug Glenn (DG): Welcome to this special edition of Heat Treat Radio, a product of Heat Treat Today. We’re calling this special episode “Heat Treat Tomorrow: hydrogen combustion. Is it our future or is it just a bunch of hot air?” This discussion is sponsored by Nel Hydrogen, manufacturers of on-site hydrogen generation systems. I’m your host, Doug Glenn, the publisher of Heat Treat Today and the host of Heat Treat Radio. I have the great privilege of moderating this free-for-all discussion today with five industry experts who I’d like to introduce to you now.

Electric Power Research Institute (EPRI)

President

WS Wärmeprozesstechnik GmbH

First, Perry Stephens. He is the principle technical leader of the Electric Power Research Institute (EPRI) and currently leads the end-use technical subcommittee of the low carbon resource initiative (LCRI) which is a collaborative eff ort with the Gas Technology Institute (GTI), and nearly 50 sponsor companies and organizations. They aimed at advancing the low carbon fuel pathways on an economy-wide basis for the achievement of decarbonization. EPRI is a member of the Industrial Heating Equipment Association (IHEA).

Joachim Wuenning (Joe Wuenning) is the owner and CEO of WS Thermprocess Technic Gmbh [WS Wärmeprozesstechnik GmbH] in Germany and WS Thermal Process Technology, Inc. in Elyria, Ohio. Joe’s company has been on the cutting edge when it comes to hydrogen combustion. In fact, the last time I heard you, Joe, was at the Thermprocess show in Düsseldorf, where you gave the keynote address regarding the advent and development of hydrogen combustion. Joe’s company has been a leader in hydrogen combustion. Joe’s company is an IHEA member as well. Joe is our European representative, and may provide us with a different perspective.

John Clarke is the technical director of Helios Electric Corporation (Fort Wayne, Indiana), a company that specializes in energy and combustion technologies. John is also a regular columnist for Heat Treat Today and a past president of IHEA.

Jeff Rafter is vice president of sales and marketing for Selas Technologies out of Streetsboro, Ohio and has a rich history in the combustion industry as well, including many years with Maxon Corporation. He’s got 28 years of industrial experience in sales, research and development, and marketing. He’s a combustion applications expert in process heating, metals refining, and power generation and has also served 10 years on the NFPA 86 committee and holds a patent for ultra-low NOx burner designs. He is also an IHEA member.

Finally, we have Brian Kelly with an equally rich history in combustion, spending most of his years at Hauck Manufacturing in Lebanon, PA, where he did a lot in sales and engineering before they were purchased by Honeywell. Brian currently works for Honeywell Thermal Solutions and is also an IHEA member.

Gentlemen, thank you for joining us. Let’s just jump right in. Brian, since I picked on you last, let’s go to you first on the questions.

Technical Director

Helios Electric Corporation

Source: Helios Electric Corporation

Selas Heat Technology Company, LLC

Honeywell Thermal Solutions

Is Hydrogen Combustion the Future?

DG: Is this hydrogen combustion thing coming? And, if so, how soon and what’s driving it?

Brian Kelly (BK): It is coming and there is going to be a lot of back and forth in that it doesn’t make sense and all that. It is here. We’re seeing inquiries from customers that ask, “Hey, do we have burners that do this, control systems and stuff that do that?” The news that I get emails on, for example, is that with one of the steel companies in Europe, they already said their plan is totally going to be hydrogen. We’re delivering billets right now of hydrogen.

So, yes, it’s coming. Is it coming soon? It’s here today. Widespread? That’s going to be a longer road. I think you’re going to hear from people that know more about it than I do, but, certainly from industry buzz, we’re testing burners, we’re making sure our burners run on partial hydrogen, full hydrogen, safety valves, control valves, and all that is definitely within a lot of the testing that we’re doing right now beyond the usual R&D on lower emissions burners and things of that nature.

Jeff Rafter (JR): I have a slightly different answer, but I agree with Brian. I think hydrogen combustion has been here for over a century. The difference has been, it’s been largely restrained to a few industries that have a regular hydrogen supply. A great example would be refining and petrochemical industries. We have had, for literally decades, burners designed to burn pure hydrogen, for example, in applications like ethylene crackers.

The fundamentals of hydrogen combustion are very well known. The next evolution that we’re currently in the process of seeing is taking more industries into an availability of hydrogen as a fuel and modifying designs and process heating equipment to accept it. There are fundamentally a lot of changes that occur when you switch the fuel, and we can get into more of those later with more relevant questions, but it doesn’t come without challenges. There is quite a bit to be done, but I think the fundamental science is already well-known. There is a lot of design work to be done and there is a lot of economic and supply development yet to be had.

John Clarke (JC): Yes, I certainly think it is coming, but the timing is uncertain. And, when I say “coming,” I mean deployed in a certain or large volume. When we simply talk about hydrogen, I do think the order of deployment is somewhat predictable and when it comes to pure hydrogen, I think it will likely be deployed first for transportation, and only after that need is met, as a process heating fuel, widely. Now, if there is a breakthrough in battery technology, this order of deployment may change. But, right now, it looks like hydrogen represents an opportunity for higher energy density for long haul transportation. And, if we’re pushing hard to reduce CO2 or carbon emitted, I think policy will be implemented in a means to maximize a reduction of carbon. That’s where I think they’ll be pushing harder.

Now, that said, partial hydrogen, blending hydrogen into natural gas, is likely to occur perhaps sooner than that.

Joachim Wuenning (JW): Not really. I think a lot of things were said correctly and I strongly believe it has to come. If you believe in climate change, it must happen because we cannot use fossil fuels forever. I also don’t believe that we will have an all-electric world. I don’t believe in nuclear power, so we cannot get all our energy from that, therefore, chemical energy carriers will be necessary for storage and long-haul transportation. Is it coming soon? Of course, it is hard to predict how fast it will be. Now, fossil fuel is cheap so it will be hard to compete with as hydrogen is likely to be more expensive.

But certainly, what we see is the requirement from our customers to have hydrogen ready burners. Because, if they invest in equipment at that point, why would they buy a natural gas only burner. They should, of course, look for burners which are able to do the transition without buying all new equipment again. So, we have a lot of projects momentarily to demonstrate the ability of the equipment to run with hydrogen or natural gas and, preferably, not even readjusting the burners if you switch from one to another gas.

Perry Stephens (PS): I’ll try to add something a little different. At EPRI, we’re charged with providing the analysis and data from which other folks, like these gentlemen, are going to try to base important business decisions. Our work hasn’t focused specifically on hydrogen, but, more generally, the class of alternate energy carriers — molecules, gas, or liquid — that can be produced in low carbon first energy ways through renewable energy sources. A lot of our work is focused on understanding the pathways from the initial energy which as a biomass source, solar, wind, could be nuclear, could be hydro. These sources of electric power that ultimately have to be used to produce this low carbon hydrogen. One other pathway is hydrogen or hydrogen-based fuels produce the steam methane reformation process which uses a lot of hydrocarbons but would then require carbon capture and sequestration. The CO2 from these processes could be employed in a circular economy fashion. So, we look at all of these.

The real challenge is the challenge of cost. How do you produce this hydrogen or alternate fuel? And there are many other potential fuel molecular constructs that could be deployed. Ammonia is one being discussed in some sectors. And then how do you transport them, store them, and what is their fuel efficiency and the cost of either new equipment or conversion of existing equipment to deploy those. We’re not specifically focused on hydrogen. It is a very important energy carrier. It can be blended with fossil fuels in the near-term and then maybe expanded in the long term to higher percentages up to pure hydrogen depending on the application, depending on where you produce it. These costs must be evaluated and that is a big job that we’re doing at EPRI with our LCRI initiative right now. We are trying to understand that techno economic analysis, that is, what makes the most sense for each sector of the economy.

Why Not Electricity?

DG: Thanks, guys. Joe had mentioned global warming, a driving force here. Why not electricity? Why don’t we just convert everything over to electricity? Perry, you’re with EPRI, let’s start with you on that. Instead of going just straight-out hydrogen, why not just go to electricity?

PS: I think the question again rephrased might be, “when electricity and when hydrogen” because I think that’s really what we’re trying to decide. There are interesting areas of research involving catalysis techniques that dramatically improve the net energy efficiency of chemical processes, for example, that might make direct electrification of certain processes more competitive. There are electric technologies for the low- to midrange temperatures that are attractive and use pieces of the electromagnet spectrum to produce transformation of products, heating and/or other transformations, that are very cost effective today. So, we judge that a portion, maybe something approaching 30% of the remaining fossil fuel, could be electrified. A certain chunk, a quarter, maybe reduced consumption through energy efficiency, 30% or more through electrification. It’s that difficult-to-electrify piece. Steam-based processes and other direct combustion processes where electric technologies — for one reason or another, don’t look like they offer a strong solution, at least today — that we’re really concerned with. And, both in steam production and direct combustion of fossil fuels today, many cases we’re looking at having to have some sort of alternate combustible fuel.

JC: I’m not sure I completely agree with your question. In some ways, clean hydrogen, or environmentally or low carbon hydrogen, is electricity. It is simply a different means of storing electric power because the source of that is going to be some sort of renewable power, more likely than not, photovoltaics, wind, hydroelectric; those are going to be the electricity we use to break down the water to generate the hydrogen that we then go ahead and store. So, the alternative is whether we use batteries or hydrogen to store this electricity and make it available either in a mobile setting, in a car or a truck, or off-peak times, at times when we are not able to generate electricity from renewables.

I think the question really is more along the line of end use. When are we going to be using electricity for the final end use? We’re kind of process heating guys around this table. I think it’s going to come down to economics, for the most part. And I don’t think we’re quite there yet.

JW: Electricity is fine for some applications. I’ve driven an electric car for the last 10 years, but in long range, I drive the fuel cell hydrogen car from my father, so different technologies for different purposes. There might be batch processes where I can have a break of a week if there is no sunshine and do the batch processing when electricity is available. But if I have a continuous furnace with 100 megawatts which should run 365 days a year, it will be tough to produce the electricity constantly from a renewable basis to fulfill all these requirements. I think it’s just more economic and makes more sense to use the right technology for the right processes. It’s not an either/or. Use the right technology for the right application.

BK: I would just back what Joe says. It can be selective to industry, the furnace type, or the type of material being processed. I know I’ve dealt in my career with a lot of the higher temperature type applications — ceramics and heat treating and things of that nature. If you start getting above 2000 degrees Fahrenheit and up, and especially dealing with airspace, uniformity has a lot to do with it.

Electricity can be hard to get that uniformity without moving fans and having fans that operate at higher temperatures is another challenge. It’s extremely challenging and a big cost factor. What most people have said here is that it is probably not either/or. We see a lot of electricity being used but we’re fossil fuel burner guys, so we’re going to push that efficiency and that kind of cost.

You’re not going to want to miss the rest of this thought-provoking discussion. To watch, listen, or read in its entirety, go to heattreattoday.com/2021-09-H2-Reg.

Heat Treat Tomorrow – Hydrogen Combustion: Our Future or Hot Air? Read More »

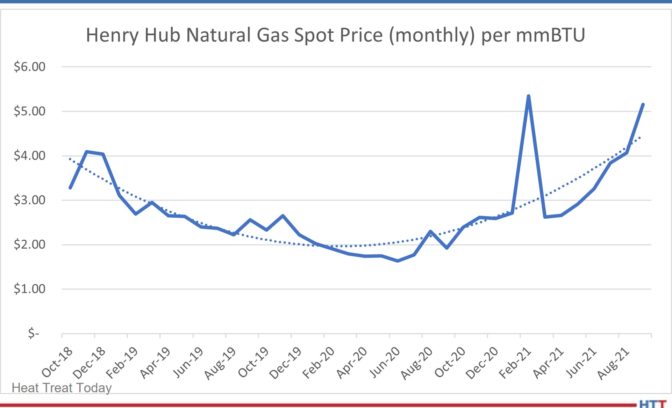

Keenan Cokain, global sales and applications coordinator and Michael Cochran, an applications engineer, both from Pittsburgh’s Bloom Engineering, an industrial combustion and controls company, add another consideration: “Natural gas is a vital primary energy source globally and will likely remain so over the next 10 years. Although energy demands will likely show an overall decline in 2020, over the next 10 years, global natural gas consumption will likely rise as it continues to grow in comparison to other fossil fuels (such as oil and coal) as a percentage of the global primary energy consumed.

Keenan Cokain, global sales and applications coordinator and Michael Cochran, an applications engineer, both from Pittsburgh’s Bloom Engineering, an industrial combustion and controls company, add another consideration: “Natural gas is a vital primary energy source globally and will likely remain so over the next 10 years. Although energy demands will likely show an overall decline in 2020, over the next 10 years, global natural gas consumption will likely rise as it continues to grow in comparison to other fossil fuels (such as oil and coal) as a percentage of the global primary energy consumed.