Heat Treat Today conducted a very unscientific and highly-fluid study on the impact of COVID-19 (coronavirus) on the North American heat treat market. By the time you read this, the impact will undoubtedly be different; but what you'll see below is a snapshot in time from Friday, February 28th, which is when most of the responses came in.

Heat Treat Today surveyed 675 heat treat industry suppliers and asked them 6 very simple questions. The survey took no more than 5 minutes to complete. Of the 675 surveyed, 104 responded, all of them completing all 6 questions.

The questions were broken down into two basic categories:

- The first two questions asked what impact the coronavirus was ALREADY having on their business.

- The last four questions asked them to speculate about the future impact of the coronavirus on their business.

Before giving the results, let me acknowledge as truth what one respondent so politely stated:

Unfortunately any information gathered for the coronavirus will be outdated within days because the global situation changes so frequently and rapidly. A survey of this kind has very limited value for business analysis/decisions due to the ... fluidity of the situation.

Having duly disclaimed, let's get on to the results.

One final note -- click on each image below to enlarge it for easier viewing.

Current Impact

Question 1: Has the coronavirus already directly impacted your business/supply chain?

As you can see, over half (51%) indicate that the virus has had NO EFFECT to date. Another 11% are uncertain if there has been any effect, and roughly 38% say that the virus has already had an impact on their business.

- Yes: 37.50%

- No: 50.96%

- Uncertain: 11.54%

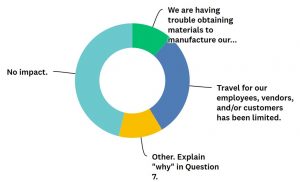

Question 2: In what way(s) has the coronavirus already directly impacted your business/supply chain?

The two main options given were:

- Difficulty getting materials to build product: 11.54%, and

- Limitation of travel either of employees, customer, or workers: 29.81%

Other answer included:

- No impact: 46.15%

- Other: 12.50%

It's not surprising that nearly half (46.15%) said there was "no impact" given that nearly half of the respondents in Question 1 indicated that there was "no impact" to date of the coronavirus on their business operations.

Anticipated Future Impact

Question 3: Do you anticipate that the coronavirus will directly impact your business/supply chain?

After assessing the current impact, the next four questions focus on the future and what expected impact the coronavirus might have on business.

The results were a bit less optimistic:

- Yes: 55.77%

- No: 18.27%

- Uncertain: 25.96%

While roughly half of the respondents indicated that the coronavirus was having no current impact, only 18% believe that it will never impact their business. The other 26% are uncertain if this global sickness will impact them or not.

Question 4: In what way(s) do you anticipate that the coronavirus will directly impact your business/supply chain?

As with question number two, which was very similar, the answers to this question indicated that the #1 anticipated impact was restriction on travel. Coming in a close second was the ability to secure materials necessary to continue production -- supply chain issues.

- Limited travel for employees, vendors, and/or customers: 40.78%

- Trouble obtaining materials to manufacture our product(s): 25.24%

- Other: 16.50%

- No impact: 17.48%

Question 5: How significantly do you anticipate that the coronavirus will impact your bottom line?

Assuming that there will be some impact, the question tried to get an order of magnitude of how great the impact might be. Asking respondents how they anticipated the virus will impact their bottom line seemed like a good approach. Here's what they had to say:

- 5% or less: 52.88%

- From 6% to 10%: 30.77%

- From 11% to 20%: 12.5%

- More than 20%: 3.85%

It's possible that everyone in the "5% or less" category said that there would be zero impact on their bottom line; but even if that is the case, there are still 47% of the industry who believe that the coronavirus will have a 6% or greater impact on their bottom line. Only a very small percentage (4%) believe that it will have a 20% or more hit on their bottom line.

Question 6: How long do you anticipate the coronavirus will impact your business/supply chain?

This final question tried to get a sense of how long respondents thought the virus would continue to impact their business.

Here's what they had to say:

- 0-2 months: 28.85%

- 3-6 months: 63.46%

- 7 months or more: 7.69%

Fortunately, it doesn't appear that the impact will be long-lived.

Question 7: Open-ended comments.

The survey was anonymous, so respondents seemed to feel comfortable giving their opinions. On two of the questions, Question 2 and Question 4, where they had the option to respond "Other," we asked them to give some explanation of their "other" response in this open-ended, final question. You can see the unedited, open-ended responses at the end of this post.

Flu vs. Coronavirus (by the numbers)

"Pandemic" is a word frequently thrown around with Coronavirus. Here are some interesting numbers from the Center for Disease Control:

CDC estimates that so far this season there have been at least 32 million flu illnesses, 310,000 hospitalizations, and 18,000 deaths from flu.

Compare that to the worldwide coronavirus numbers (as of February 28th):

- Confirmed cases: 83,700

- Deaths: 2,859

This is not to minimize the importance of actions against the coronavirus, but the current numbers associated with the coronavirus are a tiny fraction compared to a typical year with influenza. That's also not to minimize the great personal pain and suffering of anyone who has lost a close relative or friend to either influenza or the coronavirus.

Verbatim Comments

As promised, here are the unedited responses to Question 7 in Heat Treat Today's Coronavirus Survey. Some company names and any other identifiable information have been removed.

- Being close to a porous border we anticipate migration north to find better conditions for their families. This indirect contact within the Hispanic community could impact the health of our workforce.

- Contract now on hold that was signed in early January in China for [company] to supply new heat-treating equipment there.

- Cost of shipping to countries hit increased 3x.

- Deliveries will be late on finished products. Many parts come from China. More than we know.

- Difficult getting some materials. Should improve as soon as things loosen up in China. Not killing us, but an irritation.

- Economic slow down.

- Facility in China had to temporarily close until the sickness peaks and wanes.

- Human anticipation will be a negative factor

- I am a sales rep and don't see much potential impact. Large purchases may be delayed but day-to-day needs should be OK to sell and ship.

- I don’t feel it directly impacts our business unless it lasts more than a year

- I have had suppliers ask about the availability to receive materials coming from Chinese suppliers, I have had questions about delivery delays from vendors/ suppliers. We are about to see in real time how good our companies are multi-sourcing critical components and not relying on conflicted materials.

- I have two major concerns: 1. The virus will become Pandemic effecting world economy, 2. In the US people will overact and panic.

- I think it is overblown, .1% of people die from the “normal strains” of flu, .7% from coronavirus. So if you get it, less the. 1% chance of death. Makes good news.

- It appears it is directly affecting some of our upcoming travel plans, as well as we expect some parts issues to arise.

- It might hurt our customers production, hence the trickle down

- Little impact for us other than limiting travel. Our supply chain is stable for the moment.

- Our business supply chain, business travel, product distributors have all been affected.

- Shipping companies like FedEx won't ship our ordered products to China. I believe that will start to affect our other international customers.

- Short term (3-6 month) impact anticipated in regard to supply of components from China and respiratory masks.

- Slower sales cycle for cap-ex type projects. A wait-and-see mentality with purchases.

- Some North American heat treaters have been purchasing Chinese castings sold by American based distributors. These castings are not marked with country of origin, so we encourage those who may be unaware where their castings are made to insist this information be provided. We are seeing many of our customers, who chose to go away from [company] and buy these off shore castings, unable to have their needs met. We manufacture our castings in our foundry in [location] and source our raw materials from domestic mills. So our supply chain and output is uninterrupted.

- Some of our customers are global, we suffer if they suffer.

- Some of the parts we are currently processing are being sourced by our customer from both China and South Korea. We have not had any delays in receiving parts but expect it to happen in the near future.

- The supply chain is disrupted. But projects slated for China have been cancelled or severely delayed affecting order input.

- This week I was at several customers who are screening for international travelers and not permitting anyone in their building who has traveled to China in the last 2 weeks.

- Travel for our sales team may be limited. Economic concerns and supply chain issues affecting our customers could potentially slow our sales bookings. We do not expect a direct supply chain problem with our raw materials.

- Travel has been altered and changed but not yet limited if required. However, we had international visitors returning home just today and they were quite concerned about the journey. We are not as much worried about the material supply yet, but thinking forward to critical items which may be impacted and considering changes to stocking programs considering our short term materials forecasts.

- Unfortunately any information gathered for the coronavirus will be outdated within days because the global situation changes so frequently and rapidly. A survey of this kind has very limited value for business analysis/decisions due to the survey fluidity of the situation.

- We anticipate the effects to vary; potential for some interruption to material availability and/or increases to material pricing. If China/India/Europe continue to be affected by the spread of Coronavirus, we suspect it may create a "bump" in thermal processing demand stateside. Although, if the spread of the virus becomes more prevalent stateside, a substantial shift in operational parameters may occur, which effects to our industry would be difficult to speculate.

- We do not expect an impact

- We export about 25% of our sales to China, South Korea and have seen some impact of about 10% on our shipments. We … sell to the oil & gas and this is also being impacted.

- We had field service work lined up in China to relocate the furnace to Indonesia. We have had to abandon the project due to the logistical challenges and definitive need for Quarantine at both ends of travel. There is a significant drop in the amount of service business that we do in southeast Asia this year because of travel restrictions and Quarantine requirements.

- We've experienced shortages or longer lead times from some vendors products such as our [company] controls. We also have staff and some clients that have considered driving to customer service calls, sales visits, etc. where they would normally drive, to avoid airports and large public places. There has been no significant impact yet.

- When China releases restrictions, the impact will be minimal.