The monthly Industrial Heating Equipment Association (IHEA) Executive Economic Summary released in March came out a little later than usual in order to incorporate recent global banking events. Even with bank failures, heat treaters can see the economy being part of an overall forward, albeit slow, recovery from the big recession during the pandemic.

Some of the banks to collapse were Silicon Valley Bank along with others such as Signature Bank and Republic Bank as well as Credit Suisse in Europe. The continual raising of rates, by the Feds, to fight inflation exposed weaknesses in banks that were already struggling. In the aftermath of this collapse, the report states uncertainty in how the Fed will respond to inflation in the future.

While the following report shows current stability in the economic indices, there is uncertainty following the banking collapse about how the economic future will unfold. The report states, "the industrial sector is still expected to decline although the speed of that decline has slowed

a bit. The projected readings are far below the trend line . . . but has started to show some very slow recovery." Only time will tell how the banking collapse will affect the future trends.

As a first example of continuous supply chain improvement, new automobile and light truck sales are up. New cars are being produced more consistently, and people are attracted to new vehicle purchase over the high-priced used vehicle market.

Source: IHEA

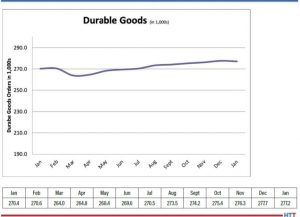

New home starts have about the same data as last month's report with the need still great for multi-family units are needed. The durable goods chart will be shown next since a good portion of that manufacturing is feeding into the new home builds.

Source: IHEA

Source: IHEA

Another economic trend for heat treaters is the steel consumption sector. Construction is going strong, but know that this could drop when current projects get finished. There is hesitation in construction to embark on new projects because of financing concerns. As mentioned before, automotive is still doing well.

Source: IHEA

Similarities can be seen in the industrial capacity utilization and the factory orders scenes. When the panic due to supply chain problems hit, companies bought up as much as they could. Now, there is the opposite problem of overstock. Inventory is going to have to be sold before these numbers will start working their way up again.

Source: IHEA

Source: IHEA

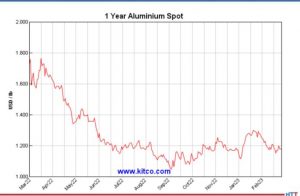

Raw metal pricing saw a huge dip with the bank failures, and the report shows this is due to investor panic. Already the numbers are leveling out.

Overall, the report is showing on-trend charts and indices. Even with the bank scares recently, the economy is not radically dropping and changing. Things are straightening out - slowly, slowly - as the recession moves more and more into the rearview mirror.

Check out the full report to see specific index growth and analysis which is available to IHEA member companies. For membership information, and a full copy of the 11-page report, contact Anne Goyer, executive director of IHEA. Email Anne by clicking here.

Find heat treating products and services when you search on Heat Treat Buyers Guide.com

Find heat treating products and services when you search on Heat Treat Buyers Guide.com