The monthly Industrial Heating Equipment Association (IHEA) Executive Economic Summary this September reiterates the point that it has been making for several months this year: economic growth plus negative economic indicators equals “I don’t really know” what will happen in the economy.

Source: IHEA

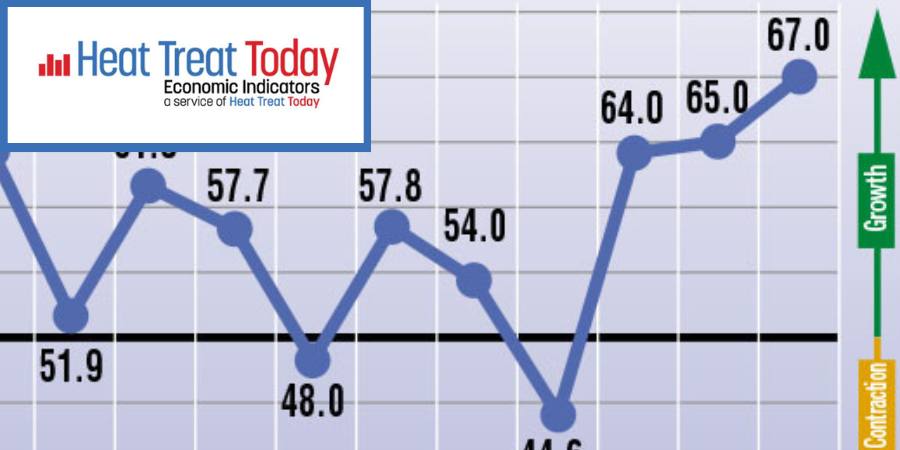

First, the summary takes time to look at contradicting economic indicators. The first example is in GDP growth: While Q1 and Q2 exhibited persistent negative GDP growth, Q3 projections of 1.3% positive growth is a promising sign that the threat of a recession is starting to fade. Other indicators also show borderline economic stability and possibly growth; with unemployment rates being low and seeing capacity utilization numbers in normal range and the Purchasing Manager’s Index in expansion zone (both just barely), “there are as many factors suggesting recession as there are factors that point towards slow growth but growth, nonetheless.” The economic summary projects the following in this borderline hopeful situation: “My own analysis of the situation (for what it is worth) is that the US will escape a formal recession in 2022 or 2023 but will experience a downturn of some significance as compared to where we were in 2021.”

Source: IHEA

Second, the summary evaluates the causes for inflation, a hot topic and a very visible, uncomfortable sign. We’re looking at three variables for this assessment: lockdowns, the energy crisis, and reshoring. “The estimate,” relates the economic summary, “is that the lockdowns cost upwards of $10 trillion in lost wages, shuttered business, health care costs and the like. The $800 billion [in U.S. stimulus money] did not offset the economic loss and was therefore not inflationary. There was a surge in inflation in early 2021 as the restrictions started to lift and people started to spend again but most of that pressure had dissipated by Q3. There would have been reduction in inflation pressure had there not been other factors.” The next cause for inflation, the energy crisis, was caused by the War in the Ukraine since Russia’s invasion of the Ukraine effectively cut off the world’s second largest producer of oil from the global economy. The energy crisis and inability to access many goods after shutdowns and wartime supply chain disruptions has also led to much reshoring in the U.S. With reshoring — an indication of growth — comes near inevitable price increases at the expense of more secure supply chain lines: “As companies return to the U.S., they will naturally encounter higher costs – for labor, for land and the like. They will see higher regulatory costs and will encounter more limits. These will add to the costs even as these companies benefit from a more reliable supply chain.”

Executive Director

IHEA

Check out the full report to see specific index growth and analysis which is available to IHEA member companies. For membership information, and a full copy of the 11-page report, contact Anne Goyer, executive director of the Industrial Heating Equipment Association (IHEA). Email Anne by clicking here.