Finding the right metric to measure the ubiquitous heat treat economy is like trying to take the temperature of the ocean. It can be hot in some spots, cold in others, and an average temperature really doesn’t help anyone. Finding economic data that can help suppliers to the heat treat industry plan future business fluctuations is all but impossible. Industrial Heating magazine has been publishing its Economic Indicators for well over a decade. This is one of the best sources for heat treat-specific economic data freely available to the public. Click here for the latest numbers from Industrial Heating.

The Industrial Heating Equipment Association (IHEA) provides a monthly Executive Economic Summary to their members as well. According to the most recent report from IHEA, the signals are mixed as to where the heat treat economy is headed. Below are a few highlights. To access the full report, please contact Anne Goyer, Executive Director of IHEA by clicking here.

- Factory Orders — headed up.

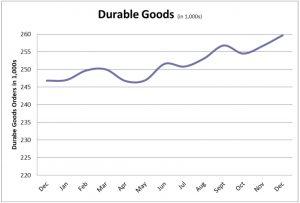

- Durable Goods — headed up.

- Transportation Index — headed up.

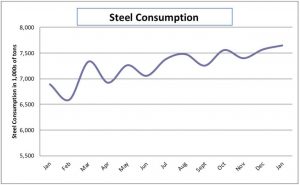

- Steel Consumption — headed up.

All of the above indices are headed north, but exactly what impact does each have on the heat treat industry?

- Industrial Capacity Utilization — headed down.

- Metal Prices — softening.

- Purchasing Managers Index — down.

- Capital Expenditures — down.

Likewise, these four indices headed south but their impact on the heat treat industry is not easily discernible.

A more complete understanding of the direct impact of the above eight (8) indices plus three (3) others on the heat treat industry can be gained by the analysis provided in the IHEA Executive Economic Summary report. The monthly report dedicates one page to each of eleven (11) heat treat-related indices with in-depth analysis by IHEA’s contracted economist.

In my eyes, the data and analysis provided by IHEA is one of the most valuable pieces of economic heat treat data a heat treat industry supplier can have.

Contact Anne Goyer for more information on this report.